Leasing Versus Buying a Car | Fiore Toyota

So, you found your dream car and now you’re asking yourself how you want to pay for it. The decision to buy or lease a vehicle depends on your own individual needs and other monthly costs, so it’s important to consider your options carefully before jumping into anything.

We at Fiore Toyota are here to make sure you have all the information you need so that you can decide if buying or leasing is the best option for you.

What is Leasing?

Leasing a car means you don’t pay the full value, rather you only pay for the depreciation of the vehicle during the term of your lease, plus interest and fees. After the term ends, you must return the car to the dealership and decide whether to walk away, buy it, or lease a new car.

Fast Facts: Leasing a Car

- Lease terms usually last 2 or 3 years (can be negotiated with your dealer)

- Lease contracts have mileage limits, and if you exceed them then you must pay an excess mileage penalty

- You can’t customize your vehicle because it must be returned in the condition it left the showroom, minus normal wear-and-tear

- The dealership decides what “normal wear-and-tear” is for the term of your lease, and if your vehicle does not fit those standards, then you must pay excess wear-and-tear charges

- If you end the lease before it expires, the early termination fees due upfront may be just as costly as sticking out the contract

- There is a possibility of lease equity, which is when your car is worth more at the lease-end than the buyout that was established, so you can use the difference towards a new lease or purchase

- Important Terminology

- Capitalized cost (cap cost) is the full price of the vehicle

- Residual cost is the vehicle’s expected value at the end of the lease period

- Money Factor is the rate of interest

So, the formula goes:

Capitalized Cost - Residual Value + Interest (based on Money Factor) + Fees = the Amount You Pay When Leasing

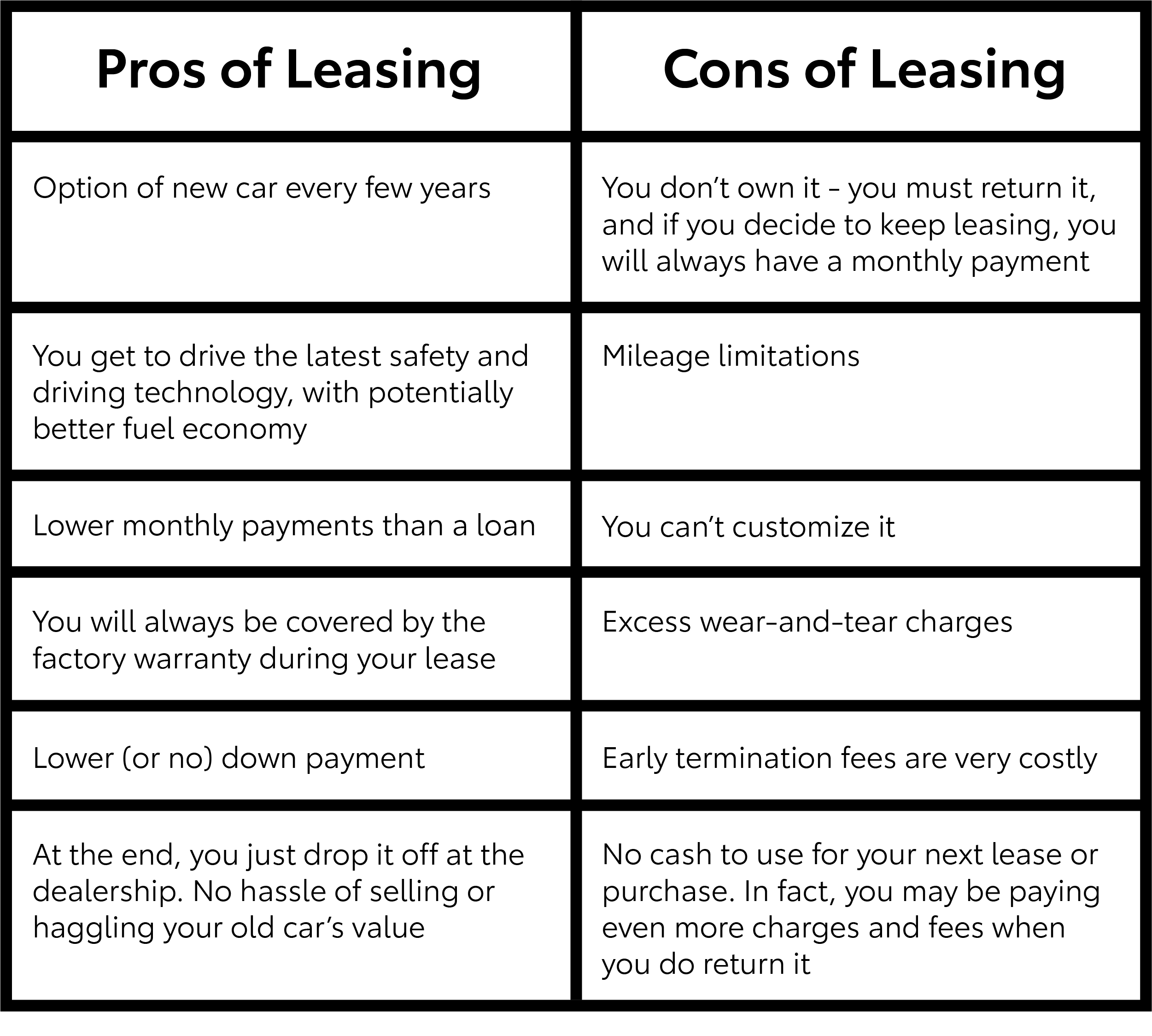

Now that we’re more familiar with what a lease is, let’s get practical with a list of pros and cons:

Although the lower monthly payments of a lease may seem attractive, it might actually end up costing you more than buying would in the end. You must consistently maintain the condition of the vehicle and abide by the many contract terms, or you’ll be facing steep penalties and fees. Plus, you won’t make anything back when you return it to the dealership like you would if you were to trade-in or sell a purchased vehicle.

Some helpful tips to avoid extra costs are questioning what “normal wear” means to your car dealership, not procrastinating on maintenance, keeping a close eye on your mileage, and studying the lease terms. Essentially, if you want to lease, you have to be diligent. If that isn’t you, maybe buying would be a better option.

What is Buying?

Buying a car means you pay the entire negotiated price of the vehicle, and therefore you own it. You may pay in cash, in financing, in the value of your trade-in, or a combination of them all.

Fast Facts: Buying a Car

- You can buy a car in cash (plus your trade-in value, if applicable) and it will immediately become yours, or you can get an auto loan

- If you finance, there is still a sizable down-payment you must make on the car

- Auto loan terms usually last between 2 and 8 years, which can vary your monthly payments to what you can afford

- The lender will hold the title of your vehicle until the loan is paid off

- If you keep the vehicle for many years, the factory warranty will eventually run out and you will have to pay for repair costs out of pocket

- You can build a lot of equity if your car payments outpace the depreciation rate of the car (whereas those who lease never have equity in their vehicle)

- Since its yours, there is overall more flexibility and less restrictions to worry about

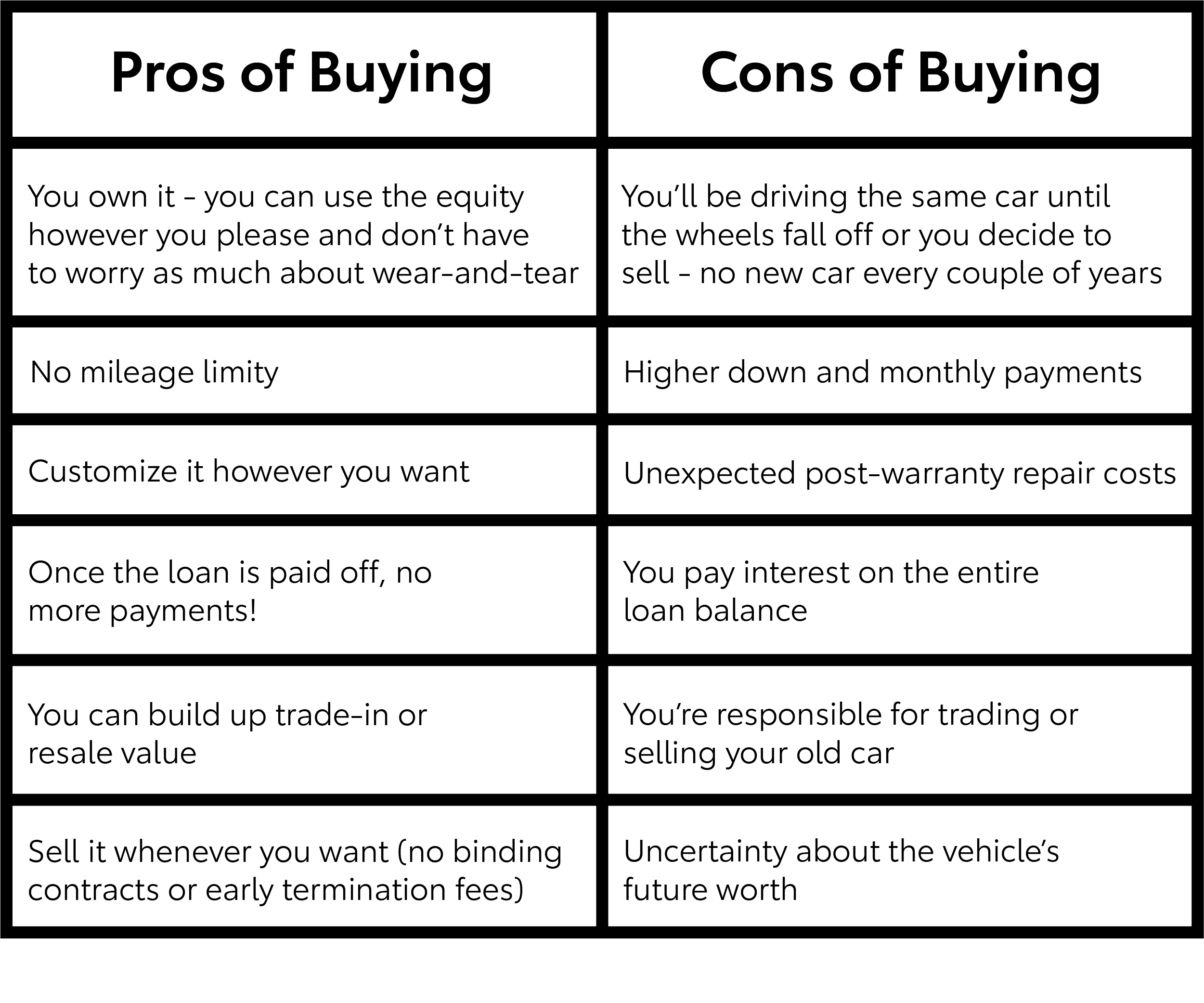

Again, lets get practical. What are some pros and cons of buying a car?

Even though the immediate costs are much higher when purchasing a vehicle, you may be able to save more money over the long term this way. Plus, you’re free from the restrictions of a lease like mileage caps or customization, and there is no risk of lease-end charges. However, the finance charges you would pay for trading-in early on a long-term loan may make it so that leasing would’ve been a better option. So, do the math. Take the time to read the fine print and consider your present and future needs.

The Best Option for You

Are you pinching pennies or have tons of other monthly costs? Do you value being on the cutting edge of technology and trying new things every few years? Are you sparing in your mileage and use of your vehicle? Maybe leasing is the right option. But remember that your monthly payments won’t end in ownership. Instead, it will most likely mean another lease and more monthly payments.

Do you live in a crowded city, drive far distances, or have an overall higher potential to dings, bumps, and excessive wear and tear? Do you wish to customize your car or drive it for a long time? Are you willing to take on a sizable monthly expense? Perhaps think about owning your next vehicle.

We don’t have the magic answer for which option is the right one for you, but asking the right questions will bring you closer to finding it. Consider consulting with one of our sales and leasing specialists at Fiore Toyota to help determine what will work best with your lifestyle.